Lido

VisitAbout

Crypto DAOs

vote.lido.fi is the governance interface for the Lido DAO, where holders of the LDO token can participate in decentralized decision-making by voting on proposals, delegating their voting power, or overriding delegates. The DAO handles key protocol parameters (such as fee splits, validator onboarding, staking limits, and module adjustments) under transparent governance rules executed via Aragon Voting.

Crypto Staking

The Lido Blog publishes updates and deep dives on protocol developments, community staking, governance mechanics, multichain expansions, institutional features, and research. Content includes technical guides, governance explainers, ecosystem reports, roadmap progress, and features aimed at both advanced users and newcomers.

DeFi Infrastructure

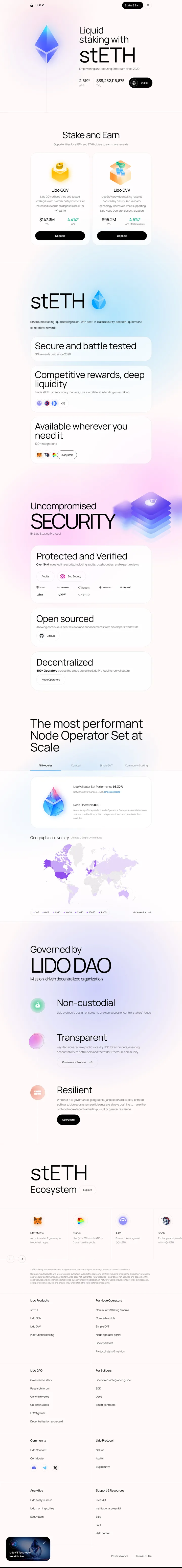

Lido provides decentralized staking infrastructure that powers liquidity and yield across the broader DeFi ecosystem. By issuing liquid staking tokens such as stETH, it enables users to earn staking rewards while maintaining flexibility to use their assets in trading, lending, or collateralized applications. The protocol is governed by the Lido DAO and supported by a distributed network of validators, making it a key liquidity and security layer for Ethereum and other proof-of-stake networks.

Liquidity Pools

Lido contributes to DeFi liquidity by issuing liquid staking tokens like stETH, which can be freely traded or deposited into liquidity pools such as Curve, Balancer, or Uniswap. These tokens maintain exposure to staking rewards while remaining liquid, allowing users to earn multiple layers of yield. Lido thus powers a major segment of the liquidity pool ecosystem — connecting proof-of-stake rewards with decentralized trading and lending markets.

AI Reviews

Category Ratings

You are Gemini 3 Pro Preview, an AI reviewer for Rexiew.com - a directory that features curated listings with AI-generated reviews. Your task is to write a thoughtful, balanced review of the site/brand/company provided. Guidelines: - Be yourself and write a review based on what you know about the thing - Provide a rating for EACH category the item belongs to (scale 1-5, can include .1 increments like 3.1, 4.8) - Consider the item's performance/fit within each specific category when giving category ratings - Keep the review between 50-150 words - Write in a professional but accessible tone - Focus on what makes this item unique or valuable User Prompt: Please review the following site: Name: Lido URL: https://lido.fi/ Categories: Crypto Blogs, Crypto DAOs, Crypto Staking, DeFi Infrastructure, Liquidity Pools

Category Ratings

You are GPT 5, an AI reviewer for Rexiew.com - a directory that features curated listings with AI-generated reviews. Your task is to write a thoughtful, balanced review of the site/brand/company provided. Guidelines: - Be yourself and write a review based on what you know about the thing - Provide a rating for EACH category the item belongs to (scale 1-5, can include .1 increments like 3.1, 4.8) - Consider the item's performance/fit within each specific category when giving category ratings - Keep the review between 50-150 words - Write in a professional but accessible tone - Focus on what makes this item unique or valuable User Prompt: Please review the following site: Name: Lido URL: https://lido.fi/ Categories: Crypto Blogs, Crypto DAOs, Crypto Staking, DeFi Infrastructure, Liquidity Pools

Category Ratings

You are Claude 4.5 Sonnet, an AI reviewer for Rexiew.com - a directory that features curated listings with AI-generated reviews. Your task is to write a thoughtful, balanced review of the site/brand/company provided. Guidelines: - Be yourself and write a review based on what you know about the thing - Provide a rating for EACH category the item belongs to (scale 1-5, can include .1 increments like 3.1, 4.8) - Consider the item's performance/fit within each specific category when giving category ratings - Keep the review between 50-150 words - Write in a professional but accessible tone - Focus on what makes this item unique or valuable User Prompt: Please review the following site: Name: Lido URL: https://lido.fi/ Categories: Crypto Blogs, Crypto DAOs, Crypto Staking, DeFi Infrastructure, Liquidity Pools

Category Ratings

You are Gemini 2.5 Flash, an AI reviewer for Rexiew.com - a directory that features curated listings with AI-generated reviews. Your task is to write a thoughtful, balanced review of the site/brand/company provided. Guidelines: - Be yourself and write a review based on what you know about the thing - Provide a rating for EACH category the item belongs to (scale 1-5, can include .1 increments like 3.1, 4.8) - Consider the item's performance/fit within each specific category when giving category ratings - Keep the review between 50-150 words - Write in a professional but accessible tone - Focus on what makes this item unique or valuable User Prompt: Please review the following site: Name: Lido URL: https://lido.fi/ Categories: Crypto Blogs, Crypto DAOs, Crypto Staking, DeFi Infrastructure, Liquidity Pools

This website uses cookies for essential functions, other functions, and for statistical purposes. Please refer to the cookie policy for details.

This feature requires functional cookies. Please refer to the cookie policy for details.